If you are experiencing a power outage, please call our office at 620-227-2139 or 800-279-7915. Thank you!

Managing Growth and Power Generation Challenges

Trends and developments in the energy industry present several challenges for power providers at every level. Careful analysis is needed to understand complex issues, including supply and demand fluctuations and other factors that affect the ability to provide safe, reliable and affordable power for homes and businesses. As 2025 concludes, let’s take a look at current power industry trends and consider the prospects for 2026.

More Demand, More Power Generation

You have likely read about the rapidly increasing demand for electricity, driven largely by industrial expansion and the growth of data centers and artificial intelligence. Electrification in transportation and heating and the expansion of domestic manufacturing have also greatly increased the demand for electricity in the United States — and the demand will continue to grow.

Electricity generation has also grown rapidly as a result of that increased demand. The U.S. Energy Information Administration (EIA) said in its September 2025 Short-Term Energy Outlook it expects total generation by the U.S. electric power sector will grow by 2.3% in 2025 and 3% in 2026.

EIA forecasts that solar power will supply the largest share of the increase in new electricity generation in 2025 and 2026. We can see evidence of the growth of wind and solar projects right here in Ford County. Although there have been policy shifts and rollbacks of tax credits and incentives for solar generation under the current administration, renewable energy is still expected to play an important part in growing generation capacity. Battery storage capacity is growing as well.

Fossil fuels remain the dominant source of the country’s electric energy, and current energy policies prioritize the further development of coal and natural gas generation. Coal plants are still being retired, while new power sources, transmission lines and gas pipelines face permitting delays, local opposition and supply chain problems. Pending legislation aims to streamline the permitting process and standardize the requirements for permits.

Though EIA predicts U.S. solar, wind, hydropower, nuclear and coal generation will grow in the coming year, it does not expect natural gas production to grow much. Supply chain constraints for natural gas turbines may slow the addition of natural gas facilities, and some reports indicate that backlogs for gas turbines might mean wait times of more than five years. Liquefied natural gas exports are also expected to increase considerably while natural gas generation remains relatively flat, so natural gas prices are expected to increase.

Rising Costs

Rising Costs

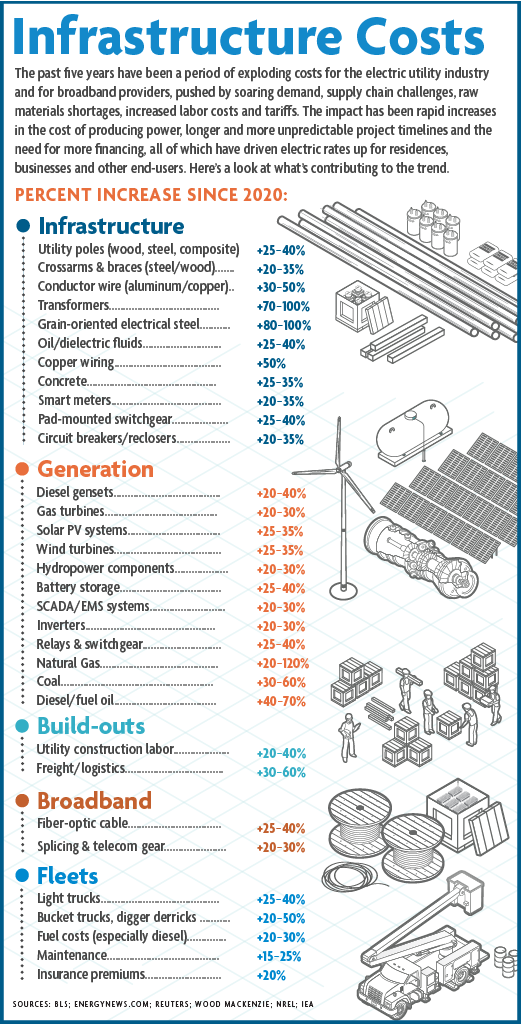

Meeting power supply needs is a balance between minimizing energy costs and managing risks. In the past five years, electric utility industry costs have increased significantly because of supply chain challenges, materials shortages and increased labor expenses. Tariffs on copper, steel and other imported materials needed for producing transformers and other infrastructure components also raise the cost of producing energy.

Victory Electric’s generation and distribution utility, Sunflower Electric Power Corp., maintains a diverse portfolio of owned and purchased generation resources, using multiple technologies and fuel sources. This energy mix helps them manage market risks and keep member rates competitive. As Victory Electric, Sunflower Electric and the Southwest Power Pool (SPP) navigate rising industry costs, we are always looking ahead and exploring more ways to control costs for our members.

Preparing for Growth

Adding large loads such as data centers to a system may cause some growing pains, but it also contributes to an electric cooperative’s gross margins. The large amount of continuous electricity demand from a data center is a predictable, stable demand that can help optimize generation and support grid stability. Victory members also benefit from larger loads connecting to our system. Selling more kilowatt-hours reduces the average wholesale energy cost for our member-owners by spreading out fixed costs.

As industrial customers look to expand throughout SPP’s territory, the SPP board recently approved guidance on integrating new interconnections of large loads such as data centers and manufacturing facilities. This policy will help SPP facilitate the connection of large users of electricity to the power grid while continuing to support the energy needs of its entire region.

To navigate these trends, cooperatives are developing new rate structures, contract provisions and financial policies for data centers and other high-load customers. This will enable them to recover costs, prevent cost shifts to other members, manage risks and ensure adequate resources are available to accommodate future growth.

The U.S. generation mix continues to evolve based on different load requirements, power supply technologies and changes in federal and state policy. Administrations, market conditions, geopolitical factors and policies may vary over time, but Victory Electric and our partners remain focused on providing safe, affordable, reliable electricity to our member-owners.