If you are experiencing a power outage, please call our office at 620-227-2139 or 800-279-7915. Thank you!

Victory Electric is a not-for-profit electric cooperative with members who share in the ownership, maintenance, construction and prosperity of the cooperative. A benefit of cooperative membership and ownership is the share in the earnings/margins Victory Electric earns each year.

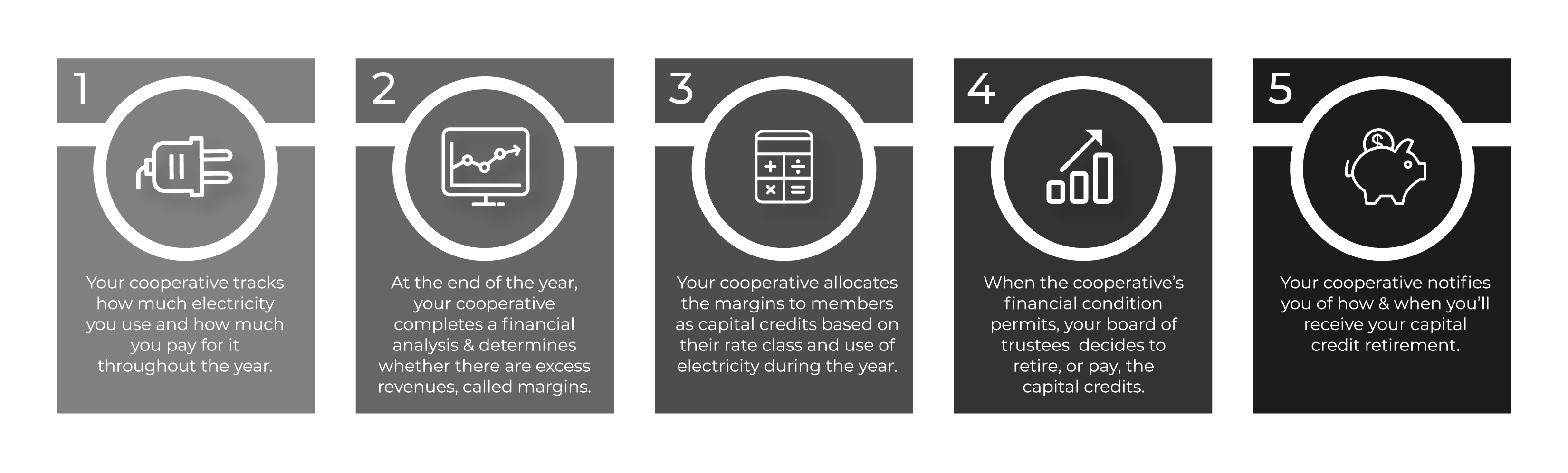

Victory Electric’s rates are set to bring in enough money to pay operating costs, make payments on loans, and provide an emergency reserve. A cooperative does not earn profits; instead, when revenues exceed the expense of providing electric service it is considered “margins” and returned to you in the form of “capital credits.” Capital credits are the difference in operating costs and revenues and denote each member’s ownership of the cooperative. The margins represent a contribution of operating capital by the membership to the cooperative with the intent the capital will be retired (repaid) to you in later years.

Thank you for being a member of Victory Electric. This information is an effort to help our members better understand capital credits and explain how your investment in Victory Electric is one way the cooperative difference works for you. A print-friendly version is available for your convenience.